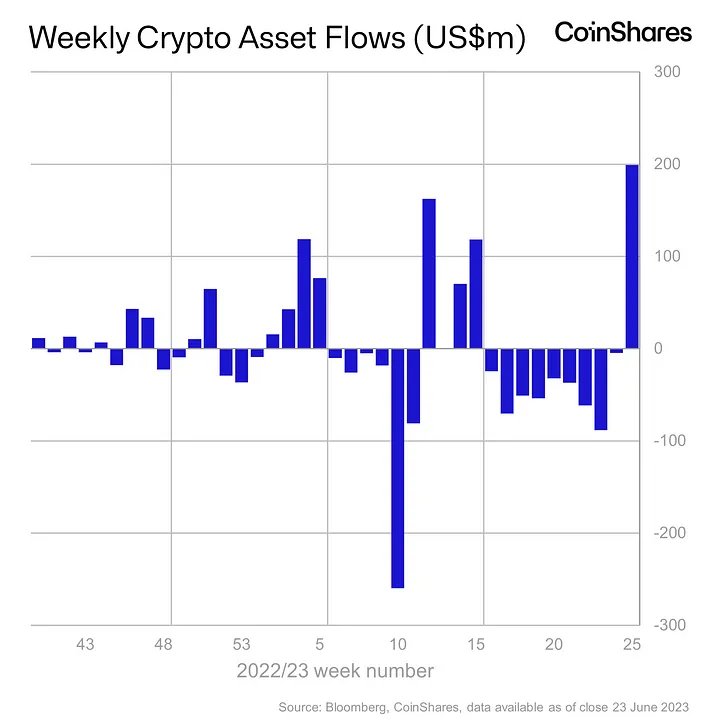

Bitcoin ETF Applications Attract Massive Institutional Inflow

As per data from CoinShares, Bitcoin (BTC) had the lion’s share alone attracting inflows of US$187m i.e, 94% of the total crypto market inflows. Institutional interest in cryptocurrencies has once again jumped higher with traditional financial players like BlackRock, Fidelity, and others joining the bandwagon. In its reports, CoinShares noted:

“ETP trading volumes were 170% the average this year, totalling US$2.5bn for the week. We believe this renewed positive sentiment is due to recent announcements from high profile ETP issuers that have filed for physically backed ETFs with the US Securities & Exchange Commission. Total assets under management (AuM) are now at US$37bn, their highest since before the collapse of 3 Arrows Capital”.

Bitcoin Dominates Altcoins

Last week, Bitcoin received $188 million in inflows, accounting for 94% of the total investment. On the other hand, investments in short-bitcoin options decreased for the ninth consecutive week, totaling $4.9 million. These outflows over the nine-week period make up 60% of the total value of assets being managed.

Ethereum experienced inflows of $7.8 million, which is only 0.1% of the total value of assets compared to Bitcoin’s inflows at 0.7%. This suggests that there is currently less demand for Ethereum compared to Bitcoin. As a result, Bitcoin’s dominance in the overall crypto market has also reached to 50%.

Recommended Articles

However, this positive change in sentiment did not have a significant impact on altcoins. Only small inflows of $0.24 million into XRP and $0.17 million into Solana. Nevertheless, the improved sentiment did encourage some investors to purchase multi-asset investment exchange-traded products (ETPs), with $8 million in inflows last week.

Amid filings for the spot Bitcoin ETF, the ProShares Bitcoin futures ETF (BITO) also recorded strong inflows last week. The total asset value for BITO surged past $1 billion.