Bitcoin price prediction amid interest rate expected hike on January 31

The Federal Reserve will hold its first “interest rate” meeting of 2024, and the finance market expects an increase. Bitcoin’s (BTC) recent price action reflects these expectations, which historically caused BTC to drop in value.

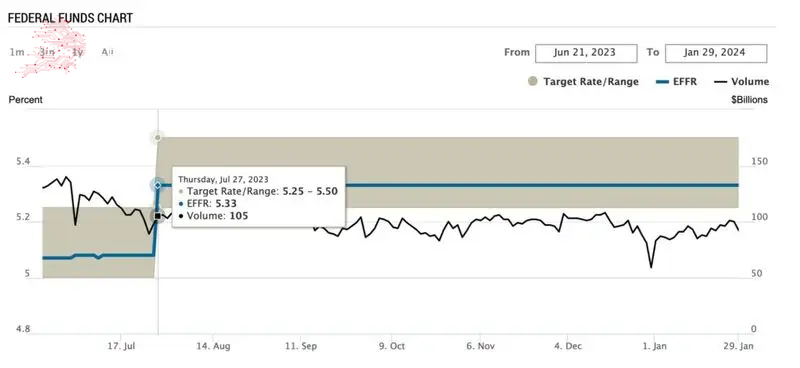

Notably, the United States central bank target rate remains unchanged since the last hike in July 2023. In the past six months, Bitcoin, other cryptocurrencies, and the stock market positively reacted to this target interest rate stability.

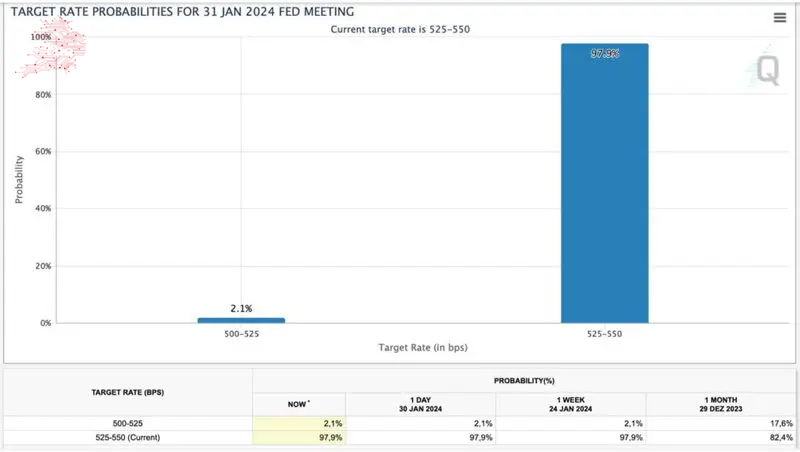

However, this scenario could change on January 31 if the Federal Reserve follows the market’s expectations. In particular, 97.9% of interest-rate traders believe the target will increase by 25 basis points (bps), according to CME Group.

Bitcoin price analysis amid target interest rate increase

Interestingly, Bitcoin has steadily traded in a consolidation range since December 2023 despite two brief deviations.

The first deviation occurred to the upside on the first trading day of the approved Bitcoin spot ETFs. Meanwhile, the second deviation happened two weeks after the first, following a “sell the news event” downtrend. These two in the $41,647.20 support level and $44,371.00 resistance level.

On December 29, only 82% of the market expected an increase by the Federal Reserve. Therefore, traders may have been trying to price this month’s interest rate decision, explaining the poor recent action.

Although this highly expected decision could have already been priced, we expect a volatile day for the cryptocurrency market. Thus, cryptocurrency traders and investors must act cautiously in the hour before and after the decision. The market may see meaningful liquidations for long and short positions as participants digest the Federal Reserve decision and communication.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment