Short squeeze alert: Bitcoin is poised to melt some faces

Bitcoin (BTC) is still in an over six-month downtrend, displaying a shorter-term side action in what the market calls consolidation. Bulls and bears are fiercely disputing the narrative, while the price illustrates analysts’ disagreement on the leading cryptocurrency’s next move.

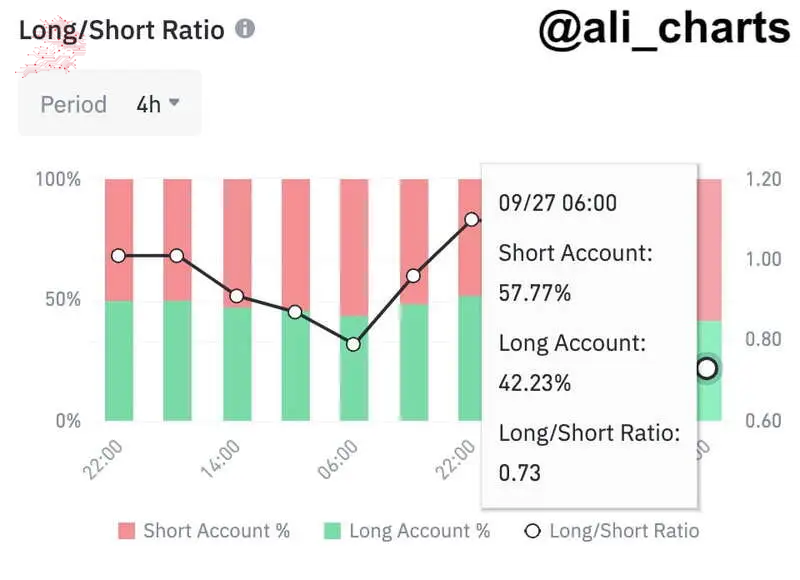

Interestingly, bear traders momentarily dominate Bitcoin’s open interest in the derivatives market, with short-sellers increasing their positions over long traders.

In particular, the long/short ratio shows that 57.77% of Binance’s open positions were shorting BTC on September 27. This data is from Ali Martinez, gathered at 6 a.m. UTC, and also displays a surge favoring the bears.

Picks for you

If this trend continues, Bitcoin short-sellers could create significant liquidity pools, acting as a magnet for a potential short squeeze.

The long-squeeze case

However, Bitcoin has already cleared some notable upward liquidity, according to the 48-hour liquidation heatmap Finbold retrieved from CoinGlass. It happened after Martinez’s report, as BTC short-squeezed above the $66,000 level, liquidating most of the opened short positions.

As things developed, the derivatives market left notable liquidity to the downside, possibly created by bulls during this rally.

Therefore, Bitcoin could see a long squeeze down to $64,000 – as the first key level – in response to this recent price action. This phenomenon illustrates the market’s volatility, with traders trying to outplay each other, hunting open positions that provide trading liquidity.

The long-squeeze scenario can also play a positive role even for long-term bulls, as explained in a recent Finbold publication. According to the editorial Analysis, Bitcoin could benefit from a short-term crash before “Uptober” starts – a view some analysts share.

Ali Martinez, for example, updated his X profile with another analyst warning of a potential correction. The Analysis looks at the TD Sequential indicator, showing a remarkable accuracy level and, thus, worth considering.

Bitcoin (BTC) price analysis as “Uptober” approaches

Following this logic, clearing the downside liquidity would be the natural movement before a potential break out of Bitcoin’s downtrend. Notably, October has been a historically positive month for BTC, receiving the “Uptober” moniker.

If institutional traders, whales, and market makers manage to clear some long positions, Bitcoin would have a clear path ahead. This, however, would happen amid a growing bearish sentiment, opening the doors for a larger short squeeze than today’s.

Credible Crypto and Alan Santana are two analysts leading Bitcoin’s short-term bearish cases, warning their followers of a crash. Besides sharing this similar vision on the leading cryptocurrency, both analysts are bullish on altcoins, foreseeing an Altseason.

Overall, building up further upside liquidity in preparation for a massive short squeeze in a bullish altcoin landscape, Bitcoin could soon “melt some faces,” surprising traders and investors who navigate the trends.

Being able to see beyond the trends and interpret the market’s behavior is what distinguishes winners from losers while trading. Yet, caution is needed together with a solid strategy and knowledge of this volatile speculation landscape.

Comments

Post a Comment